hey-co-instrument.ru

Recently Added

Etn Nyse

Is Eaton Corporation plc listed on the NASDAQ or NYSE? Eaton Corporation plc is listed on the NYSE as (NYSE:ETN). What is Eaton Corporation plc's stock. About Eaton Stock (NYSE:ETN). Eaton Corporation plc operates as a power management company worldwide. The company's Electrical Americas and Electrical Global. Eaton Corporation PLC ETN:NYSE ; Close. quote price arrow down (%) ; Volume. 1,, ; 52 week range. - Product Details. Primary Exchange. NYSE Arca. ETN Ticker. FNGS. Intraday Indicative Value Ticker. FNGSIV. Underlying Ticker. NYFANGT. CUSIP. B Issue. Stock Price, News, Quote and Profile of EATON CORP PLC(NYSE:ETN) stock. General stock ratings, overview and activity description. Stay up-to-date on Eaton Corporation, PLC Ordinary Shares (ETN) Dividends, Current Yield, Historical Dividend Performance, and Payment Schedule. Discover real-time Eaton Corporation, PLC Ordinary Shares (ETN) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Get the latest on Eaton's (NYSE: ETN) financial performance, strategy, stock information and investor presentations. Eaton Plc (NYSE: ETN). $ (%). $ Price as of August 23, , p.m. ET. Jump to: Overview. OverviewReturn vs. S&PCompany InfoNews & Analysis. Is Eaton Corporation plc listed on the NASDAQ or NYSE? Eaton Corporation plc is listed on the NYSE as (NYSE:ETN). What is Eaton Corporation plc's stock. About Eaton Stock (NYSE:ETN). Eaton Corporation plc operates as a power management company worldwide. The company's Electrical Americas and Electrical Global. Eaton Corporation PLC ETN:NYSE ; Close. quote price arrow down (%) ; Volume. 1,, ; 52 week range. - Product Details. Primary Exchange. NYSE Arca. ETN Ticker. FNGS. Intraday Indicative Value Ticker. FNGSIV. Underlying Ticker. NYFANGT. CUSIP. B Issue. Stock Price, News, Quote and Profile of EATON CORP PLC(NYSE:ETN) stock. General stock ratings, overview and activity description. Stay up-to-date on Eaton Corporation, PLC Ordinary Shares (ETN) Dividends, Current Yield, Historical Dividend Performance, and Payment Schedule. Discover real-time Eaton Corporation, PLC Ordinary Shares (ETN) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Get the latest on Eaton's (NYSE: ETN) financial performance, strategy, stock information and investor presentations. Eaton Plc (NYSE: ETN). $ (%). $ Price as of August 23, , p.m. ET. Jump to: Overview. OverviewReturn vs. S&PCompany InfoNews & Analysis.

Find the latest Eaton Corporation, PLC financial news and headlines to keep up with the events that impact ETN performance. Get the latest on Eaton's (NYSE: ETN) financial performance, strategy, stock information and investor presentations. The Weiss investment rating of Eaton Corporation plc (NYSE: ETN) is B. Real-time share price updates and latest news for Eaton Corp (NYSE:ETN). Compare across sectors, industries & regions. Like other stocks, ETN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To. The NYSE FANG+™ Index, an equal-dollar weighted index, was created by NYSE The ETN seeks a return on the underlying index for a single day. The. ETN - Eaton Corporation plc (NYSE) - Share Price and News. NYSE:ETN. SummaryFactSheetFinancial. Price. $ Loss Chance. %. JITTA Related. Allient. NASDAQ:ALNT. $ % · AMETEK. NYSE:AME. Find the latest Eaton Corporation, PLC financial news and headlines to keep up with the events that impact ETN performance. Home ETN • NYSE. add. Share. Eaton Corporation PLC. $ After Hours: $ (%) Closed: Aug 28, PM GMT-4 · USD · NYSE · Disclaimer. [NYSE]. x x Realtime by (Cboe BZX). x x ETN Related stocks. Symbol, Last, 3M %Chg. ETN, , %. Eaton Corp. Research Eaton's (NYSE:ETN) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. Nearly 80% of ETF assets are listed with us. At the NYSE we combine superior customer service with better trading and execution, and unparalleled exposure to. Get the latest stock price for Eaton Corporation PLC (ETN:US), plus the latest news, recent trades, charting, insider activity, and analyst ratings. Eaton Corp Stock (NYSE: ETN) stock price, news, charts, stock research, profile. The highest price target for ETN is $, while the lowest price target for ETN is $ Free Ratings Newsletter. This page (NYSE:ETN) was last updated. Is Eaton Corporation plc listed on the NASDAQ or NYSE? Eaton Corporation plc is listed on the NYSE as (NYSE:ETN). What is Eaton Corporation plc's stock. Stay up-to-date on Eaton Corporation, PLC Ordinary Shares (ETN) Dividends, Current Yield, Historical Dividend Performance, and Payment Schedule. Eaton's market cap is calculated by multiplying ETN's current stock price of $ by ETN's total outstanding shares of ,,

Affordable Car Subwoofers

For budget subwoofers I suggest lanzar pro's or even cheaper you can even go for Pyle blue wave subwoofers. For a budget amp, go for boss. Ready to order your dream car audio system? Don't wait, finance it today! Choose from our many partners for pay-over-time and leasing options during checkout. Car Subwoofers Sale ; JL Audio 10TW3-D8 10" Thin-Line Dual Voice Coil Subwoofer - 8 Ohm · 10TW3D8 · $ ; Kicker 46HS10 Hideaway 10" Ultra Compact Car Subwoofer. Polk car and marine speakers deliver the great sound you expect from Polk on the road or wherever life takes you. With weather-resistant designs and easy, drop. This article will explain how to find the subwoofer and bass system that's right for you. Subwoofers are speakers dedicated to reproducing low frequencies. Car. New and used Car Subwoofers for sale near you on Facebook Marketplace. Find great deals or sell your items for free. Subwoofers ; Sundown Audio LCSv2 10" inch DVC Dual 4 Ohm (LCS Series) Car Subwoofer · $ $ ; Crossfire Audio C3-V3 10" inch DVC D2 Ohm (C3 Series) Car. Shop Cheap Car Audio Subwoofers ; $ 5-Inch Car Stereo, 12V 2-Way Full R ; $ Automotive Interior Parts Ca · Free shipping ; $ Kicker 43CVR Best Buy customers often prefer the following products when searching for best budget subwoofer. · Kenwood - Road Series 12" Single-Voice-Coil 4-Ohm Subwoofer -. For budget subwoofers I suggest lanzar pro's or even cheaper you can even go for Pyle blue wave subwoofers. For a budget amp, go for boss. Ready to order your dream car audio system? Don't wait, finance it today! Choose from our many partners for pay-over-time and leasing options during checkout. Car Subwoofers Sale ; JL Audio 10TW3-D8 10" Thin-Line Dual Voice Coil Subwoofer - 8 Ohm · 10TW3D8 · $ ; Kicker 46HS10 Hideaway 10" Ultra Compact Car Subwoofer. Polk car and marine speakers deliver the great sound you expect from Polk on the road or wherever life takes you. With weather-resistant designs and easy, drop. This article will explain how to find the subwoofer and bass system that's right for you. Subwoofers are speakers dedicated to reproducing low frequencies. Car. New and used Car Subwoofers for sale near you on Facebook Marketplace. Find great deals or sell your items for free. Subwoofers ; Sundown Audio LCSv2 10" inch DVC Dual 4 Ohm (LCS Series) Car Subwoofer · $ $ ; Crossfire Audio C3-V3 10" inch DVC D2 Ohm (C3 Series) Car. Shop Cheap Car Audio Subwoofers ; $ 5-Inch Car Stereo, 12V 2-Way Full R ; $ Automotive Interior Parts Ca · Free shipping ; $ Kicker 43CVR Best Buy customers often prefer the following products when searching for best budget subwoofer. · Kenwood - Road Series 12" Single-Voice-Coil 4-Ohm Subwoofer -.

Our powered subwoofers offer big sound in a compact package for small cars. If you want everything in one quick, easy and economical package, check out our boat. Shop a wide selection of Car Subwoofers and Amps from Pioneer, Clarion & more! Newegg offers the best prices, fast shipping and top-rated customer service! Half Price Car Audio offers the best brands in car audio. We stock amplifiers, subwoofers, speakers, and more! Power Acoustik MOFOSD4 - Our choice · Skar Audio SVR-8 D2 - With deep bass · Planet Audio TQ10S - Cheap · Skar Audio EVL D4 - Compact · Toro Tech Force 12 -. Massive Audio has the best collection of subwoofers for cars, marine & pro audio subwoofers. Buy Sale price$ Regular price$ Add to cart. On AliExpress, we present to you a range of inch car subwoofers that guarantee to enhance your driving experience. With the perfect combination of size. best affordable subwoofer · best budget subwoofer · best car accessories to buy · best component car speakers · best sound system for car · buy car sound system. Categories - · 6-inch Car Subwoofers(1) · 8-inch Car Subwoofers(5) · inch Car Subwoofers(17) · inch Car Subwoofers(31) · inch Car Subwoofers(0) · inch Car. The best deals: high-quality Sub for car. Car subwoofers for cars at low prices – the AUTODOC catalogue is full of great-value deals on auto parts ✓ Spend. Shop our selection of car subwoofers and car subwoofer enclosure boxes for your vehicle. Get popular sizes like 12" and 10" as well as sizes from " subs. Affordable Bass 10" - 12" - 15" $ - $ 50 - W RMS. Sold Out on hey-co-instrument.ru These products may still be available at your local dealer. Series (Good, Better, Best). Punch - Better; Power - Best ; Family. R2; P2 ; Vented Box Volume (Vb). ; ; Sealed Box Volume (Vb). ; ; Subwoofer. In need of subwoofers for your car? Seismic Audio offers some of the best subs for sale online at prices you will love! Impedance ; 12W7AE-3 inch ( mm) Subwoofer Driver, 3 Ω · $1, ; 12W6v3-D4 inch ( mm) Subwoofer Driver, Dual 4 Ω · $ ; 13TW5v inch ( Explore Top-Quality Auto, Vehicle, and Car Electronics at Target. Upgrade Your Ride with Car Audio, Car Speakers, Dashboard Cameras, Backup Cameras. High Power 10 Inch Subwoofer Bass Cheap Car Subwoofer Refit 12V Car Speakers Subwoofers ; Production Capacity: 1~(Piece/Pieces) / 15 Days ; Model Number, K-. At Seismic Audio we believe everyone should enjoy the superior quality sound and durability of high-end car audio equipment at an affordable price. Car & Marine · BassPro SL2 · JBL BassPro Hub · JBL Stage Subwoofer · JBL Stage Subwoofer · GT-BASSPRO12 · Club WS · SSS · JBL BassPro Micro. Buy Car Subwoofers at Deep Discounts. Direct from Manufacturer Pricing. Satisfaction Guaranteed. We have Automotive Interior Stickers, Car Alarms and. Customer favorites for adding bass to your car stereo · A simple solution with superb sound — Focal BombA BP20 · A w space-saving enclosure — Rockford.

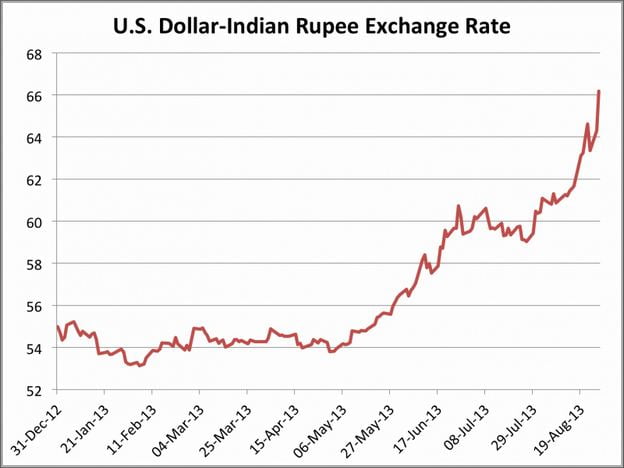

Usa Dollar To Rs

The current rate of US Dollar to INR is The expected High Low is % For 1 US Dollar, you would receive roughly INR INR 1 = $ INR = $ Learn the current USD to INR exchange rate and the cost when you send money to India with Remitly. Today hey-co-instrument.ruday 04/09/, for 1 US Dollar you get Indian Rupees. Change in USD to INR rate from previous day is +%. Moreover, we have also. USD to INR Currency (USD to INR) Exchange Rate - Last 10 Days ; Aug ; Aug ; Aug ; Aug ; Aug Use our currency converter to find the live exchange rate between INR and USD. Convert Indian Rupee to United States Dollar. US-Dollar - Indian Rupee (USD - INR)Currency · Currency Snapshot · News · Historical Prices for Indian Rupee · Currencies Pairs. 1 USD = INR · SELL 1 USD @ INR · BUY 1 USD @ INR. The year peaked on September 19, , with an exchange rate of INR, averaging at 1 US Dollar = Indian Rupee for the year. The year peaked on September 19, , with an exchange rate of INR, averaging at 1 US Dollar = Indian Rupee for the year. The current rate of US Dollar to INR is The expected High Low is % For 1 US Dollar, you would receive roughly INR INR 1 = $ INR = $ Learn the current USD to INR exchange rate and the cost when you send money to India with Remitly. Today hey-co-instrument.ruday 04/09/, for 1 US Dollar you get Indian Rupees. Change in USD to INR rate from previous day is +%. Moreover, we have also. USD to INR Currency (USD to INR) Exchange Rate - Last 10 Days ; Aug ; Aug ; Aug ; Aug ; Aug Use our currency converter to find the live exchange rate between INR and USD. Convert Indian Rupee to United States Dollar. US-Dollar - Indian Rupee (USD - INR)Currency · Currency Snapshot · News · Historical Prices for Indian Rupee · Currencies Pairs. 1 USD = INR · SELL 1 USD @ INR · BUY 1 USD @ INR. The year peaked on September 19, , with an exchange rate of INR, averaging at 1 US Dollar = Indian Rupee for the year. The year peaked on September 19, , with an exchange rate of INR, averaging at 1 US Dollar = Indian Rupee for the year.

Download Our Currency Converter App ; 1 INR, USD ; 5 INR, USD ; 10 INR, USD ; 20 INR, USD.

What is the current USD (Dollar) to INR (Rupee) Conversion Rate Today? Current exchange rate US DOLLAR (USD) to INDIAN RUPEE (INR) including currency converter, buying & selling rate and historical conversion chart. The current rate of USDINR is INR — it has increased by % in the past 24 hours. See more of USDINR rate dynamics on the detailed chart. Convert Rupees to Dollars otherwise known as INR to USD. Live conversions at of September FX: USD – INR Exchange Rates and Fees shown are estimates, vary by a number of factors including payment and payout methods, and are subject to. Histroical Currency Exchange Rate ; 30th April Rate, INR ; Highest rate in April, INR on April 19 ; Lowest Rate in April, INR on April 10 ; Over. As per today's exchange rate i.e. Tuesday 03/09/, 1 US Dollar is equals to Indian Rupees. Change in USD rate from previous day is +%. US Dollar to Indian Rupee Exchange Rate is at a current level of , up from the previous market day and up from one year ago. Latest Currency Exchange Rates: 1 US Dollar = Indian Rupee · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Rupees (INR). US Dollar to Indian Rupee Exchange Rate is at a current level of , down from the previous market day and up from one year ago. 1 USD = INR Sep 03, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy to. US Dollars to Indian Rupees conversion rates ; 1 USD, INR ; 5 USD, INR ; 10 USD, INR ; 25 USD, 2, INR. Join today and get a promotional rate of INR to 1 USD on your first money transfer, plus no fees on your first two transfers. Get latest 1 Dollar to INR rates, Dollar to Rupee conversion rates, USD INR Forex rates, USD INR rate forecast, Dollar vs rupee historical rates. This Free Currency Exchange Rates Calculator helps you convert US Dollar to Indian Rupee from any amount. Currently, 1 USD stands at approximately INR How Can I Convert US Dollar to INR in India. Some common ways to exchange US Dollar currency with INR in. Check live exchange rates for 1 USD to INR with our USD to INR chart. Exchange US dollars to Indian rupees at a great exchange rate with OFX. USD to INR. Instant free online tool for USD to INR conversion or vice versa. The USD [United States Dollar] to INR [Indian Rupee] conversion table and conversion steps. Find the current US Dollar Indian Rupee rate and access to our USD INR converter, charts, historical data, news, and more. We are a 24×7 online portal to assist you with live rupee to dollar rates. We assist to keep you hassle-free and help you analyze and provide the best exchange.

What Can U Buy With A Credit Card

Buying gift cards with a credit card can be a great way to earn extra rewards and take advantage of promotions. Start by thinking about what you want to use the credit card for. This could be to buy things on line or on holiday, to pay your bills or to spread the cost of. You should buy anything and everything using credit as long as you can pay it off when the bill becomes due. Make purchases anywhere Visa Debit cards are accepted. Plus, you don't have to worry about overdraft fees, since your spending cannot exceed the available. Credit cards come in handy for making large purchases that you want to pay off over time. For instance, if you need to buy an airline ticket but you don't have. Financing that works for you. Enjoy the flexibility of low monthly payments. Multiple plans can be open on your account. A variety of options. A credit card allows you to make purchases and pay for them later. In that sense, it's like a short-term loan. When you use a credit card to make a purchase. Alternatively, you can often use credit cards to buy “cash equivalents” like Visa and Mastercard gift cards. These are effectively prepaid debit cards. Some. 1. Your monthly rent or mortgage payment · 2. A large purchase that will wipe out available credit · 3. Taxes · 4. Medical bills · 5. A series of small impulse. Buying gift cards with a credit card can be a great way to earn extra rewards and take advantage of promotions. Start by thinking about what you want to use the credit card for. This could be to buy things on line or on holiday, to pay your bills or to spread the cost of. You should buy anything and everything using credit as long as you can pay it off when the bill becomes due. Make purchases anywhere Visa Debit cards are accepted. Plus, you don't have to worry about overdraft fees, since your spending cannot exceed the available. Credit cards come in handy for making large purchases that you want to pay off over time. For instance, if you need to buy an airline ticket but you don't have. Financing that works for you. Enjoy the flexibility of low monthly payments. Multiple plans can be open on your account. A variety of options. A credit card allows you to make purchases and pay for them later. In that sense, it's like a short-term loan. When you use a credit card to make a purchase. Alternatively, you can often use credit cards to buy “cash equivalents” like Visa and Mastercard gift cards. These are effectively prepaid debit cards. Some. 1. Your monthly rent or mortgage payment · 2. A large purchase that will wipe out available credit · 3. Taxes · 4. Medical bills · 5. A series of small impulse.

If you make a big purchase that will take a few billing cycles to pay off, don't put it on a rewards credit card! It only takes about billing cycles for. A credit card lets you spend up to an agreed amount, called your credit limit. The exact amount will depend on things like your credit history and income. Each. DO contact your credit card issuer if you have trouble making payments. The This allows you to rent an apartment, get a job, purchase a car and buy a home. Why might you want a credit card? The most straightforward way to easily you feel as if you can purchase more than your budget allows. As you will. The short answer is, entertainment and nonessentials can usually be paid with a credit card with no fees. Services, utilities, and taxes can often be paid with. What is PayPal Credit? PayPal Credit is a revolving line of credit where, if approved, you can buy something now and pay for it over time. Get to know. By making expensive purchases with credit you can pay for whatever it is you buy retrospectively over time. Flights and Holidays. Buying flights and holidays. To change your choice category for future purchases, you must go to Online Banking, or use the Mobile Banking app. You can change it once each calendar month. You can buy a money order with a credit card, but it's not a great option, as only specific merchants will accept that type of payment. How do I use credit? · You borrow money (with your credit card or loan). · You buy the thing you want. · You pay back that loan later – with interest. Avoid placing the following expenses on credit cards: Mortgage or rent, Most mortgage companies or rental agencies won't let you make your payment with credit. You can buy things online without a credit card using a debit card, prepaid card, gift card, mobile payment app, and even cryptocurrency. There are many factors that make up your credit score, and one piece is your payment history. Using a credit card to buy your groceries and then making your. Credit cards are a convenient way to make purchases. When you make a purchase, your account details are sent to the merchant's bank and forwarded by the card's. Use the credit card as a temporary loan to yourself, and then pay back the amount as soon as you can to decrease or avoid interest charges altogether. 3. Never. Many shoppers wonder if they can buy a gift card with a credit card. The answer is a simple yes. Learn more about the pros and cons of using a credit card. Buy gift card. Support You can also use a credit or debit card to top up your wallet, which can then be used to make purchases on PlayStation Store. Cards you can buy with Credit Card on eGifter · eGifter Baby Choice Card · eGifter Choice Card · eGifter Coaches Choice Card · eGifter Coffee Choice Card · eGifter. Not sure what we mean? Consider this: You want to buy a new couch that costs $1, When it comes time to check out, you decide to use a credit card —.

Oanda Brokerage

Track commodity prices, start trading on the go on the OANDA mobile app: · Buy or sell CFDs for gold, oil, sugar, soy, etc. · Trade cyclical global markets. OANDA is a well-known online forex broker that has been operating for over two decades. With a reputation for transparency and reliability, OANDA offers a wide. Boasting over 20 years in the markets, leading analysis tools and thousands of satisfied clients, OANDA is proud to be an award-winning broker. OANDA does not support Native One-Cancels-Others group. In this case MultiCharts emulates an OCO-group on its end. Simulated OCO-group means that all OCO orders. I would like to hear everyone's take on Oanda's statement. Taking into consideration that OANDA is a market-maker broker, is it still possible for OANDA to. Opening an overseas account in OANDA can be painful, but overcoming these obstacles, you will know it's the best broker. Their platform is not such easy or as. Learn more about OANDA, a leader in currency data. We offer forex and CFD trading, corporate FX payments and exchange rates services for a wide range of. Minimum Deposit. OANDA has historically stuck to requiring no minimum deposit. It ensures aspiring day traders and those with limited capital do not have to. Fully regulated, OANDA offers competitive spreads on 70 forex pairs, including all the majors and minors. Voted ""Most Popular Broker"" by TradingView three. Track commodity prices, start trading on the go on the OANDA mobile app: · Buy or sell CFDs for gold, oil, sugar, soy, etc. · Trade cyclical global markets. OANDA is a well-known online forex broker that has been operating for over two decades. With a reputation for transparency and reliability, OANDA offers a wide. Boasting over 20 years in the markets, leading analysis tools and thousands of satisfied clients, OANDA is proud to be an award-winning broker. OANDA does not support Native One-Cancels-Others group. In this case MultiCharts emulates an OCO-group on its end. Simulated OCO-group means that all OCO orders. I would like to hear everyone's take on Oanda's statement. Taking into consideration that OANDA is a market-maker broker, is it still possible for OANDA to. Opening an overseas account in OANDA can be painful, but overcoming these obstacles, you will know it's the best broker. Their platform is not such easy or as. Learn more about OANDA, a leader in currency data. We offer forex and CFD trading, corporate FX payments and exchange rates services for a wide range of. Minimum Deposit. OANDA has historically stuck to requiring no minimum deposit. It ensures aspiring day traders and those with limited capital do not have to. Fully regulated, OANDA offers competitive spreads on 70 forex pairs, including all the majors and minors. Voted ""Most Popular Broker"" by TradingView three.

Introduction. This repository hosts the OANDA Brokerage Plugin Integration with the QuantConnect LEAN Algorithmic Trading Engine. LEAN is a brokerage agnostic. broker that fit my wants and needs, account size and most importantly a regulated broker, I have liked the ease and access to the Oanda platform. Trading. OANDA is a time – tested Forex broker founded in in the United States and regulated by the CFTC, NFA, FCA and ASIC. IT provides access to Forex and CFD. Oanda Broker is packed with features designed to enhance the trading experience. Firstly, it offers real-time data, which is crucial for making informed trading. OANDA is a global leader in CFD solutions. Discover and experience our award-winning online trading platforms, available on desktop, web and mobile. PineConnector is a user-friendly bridge that enables retail traders to automate their TradingView strategies with their brokers on MT4 & MT5 using webhooks. Oanda reviews and ratings, a forex trading broker rated and reviewed by forex traders. Precision Trading With OANDA. K views. 1 year ago. Featured channels. OANDA Asia Pacific. @oanda_apac. subscribers · OANDA TMS Brokers. @tmspl. K. Beginner traders will find the familiarity of the MT4 trading platform at Oanda beneficial, while Interactive Brokers presents a suite of cutting-edge. Recent OANDA awards · Named Best in Class for Research and Ease of Use · Voted Best US Forex Broker · Voted Best Low Cost Broker · Most Popular Broker. OANDA is among the top forex brokers in the U.S. in terms of customer funds held.3 · OANDA accepts U.S. clients, though only for forex, and is registered with. Rest easy in the knowledge you'll be trading via a global broker with a stellar reputation. *Most Popular Broker (TradingView Broker Awards , , ). OANDA TMS Brokers S.A. is subject to the supervision of the Polish Financial Supervision Authority on the basis of an authorization of April 26, (KPWiG-. This Forex broker offers 68 forex pairs with the choice of a spread-only or core pricing account. OANDA also offer OANDA Trade, MT4 and TradingView trading. 1 FX Broker for the fourth year in a row by the Investment Trends Singapore CFD & FX Report. We also become one of the largest FX brokers operating in the. Instantly trade on the go with the user-friendly, award-winning OANDA forex trading app. Trade major and minor forex pairs, such as EUR/USD, USD/CAD. Oanda is one of the best brokers, iam not saying they are not shady broker so. And imo sl shouldn't be so tight I stopped doing. Money & Insurance · Investments & Wealth · Finance Broker; OANDA. Overview Reviews About. OANDA Reviews. • Great. VERIFIED COMPANY. In the Finance Broker. To view the implementation of the Oanda brokerage integration, see the hey-co-instrument.ru repository. Account Types. Oanda supports margin accounts. To. Starting with Research, QuantConnect provides robust Jupyter Lab research notebooks to load OANDA historical data since , curated and updated by our data.

When Is The Deadline To File 2020 Taxes

May 17, was the due date for IRS Income Tax Returns. October 17, was the e-File deadline for returns.:The last day to file a return. The due date for the Missouri Individual Income Tax Return is April 15, Fiscal year filers must file no later than the 15th day of the fourth month. Tax Return Dates and Deadlines · The Form tax return deadline: April 15, · Official IRS Tax Dates · State Payment Deadlines Vary · When does tax. Here you can check your filing due dates to make sure your tax return gets in on time. Excise tax returns. · · · · · · Check Return Status (Refund or Balance Due) · File and Pay Your Taxes Online Individual Income Tax Payment Voucher, , 12/3/ MOVPDF Document. The due date to file your California state tax return and pay 5 any balance due is April 15, However, California grants an automatic extension until. Important Tax dates: · On February 10, PriorTax will commence the e-file of tax returns. · From November 18, to January 22, , tax returns. Tax Day for most people was April This is when federal income tax returns are due. But some people have some extra time to file. Are you one of them? Description:If you owe Taxes, a filing deadline does not apply and late filing and late tax payment penalties might apply. The deadline to claim Tax. May 17, was the due date for IRS Income Tax Returns. October 17, was the e-File deadline for returns.:The last day to file a return. The due date for the Missouri Individual Income Tax Return is April 15, Fiscal year filers must file no later than the 15th day of the fourth month. Tax Return Dates and Deadlines · The Form tax return deadline: April 15, · Official IRS Tax Dates · State Payment Deadlines Vary · When does tax. Here you can check your filing due dates to make sure your tax return gets in on time. Excise tax returns. · · · · · · Check Return Status (Refund or Balance Due) · File and Pay Your Taxes Online Individual Income Tax Payment Voucher, , 12/3/ MOVPDF Document. The due date to file your California state tax return and pay 5 any balance due is April 15, However, California grants an automatic extension until. Important Tax dates: · On February 10, PriorTax will commence the e-file of tax returns. · From November 18, to January 22, , tax returns. Tax Day for most people was April This is when federal income tax returns are due. But some people have some extra time to file. Are you one of them? Description:If you owe Taxes, a filing deadline does not apply and late filing and late tax payment penalties might apply. The deadline to claim Tax.

Filing frequencies and return due dates for Iowa Sales and Use Tax and Withholding Income Tax Beginning in for tax year and all subsequent tax years. Description:If you owe Taxes, a filing deadline does not apply and late filing and late tax payment penalties might apply. The deadline to claim Tax. Taxes payable assessed on the basis of tax returns are due within ten calendar days following the deadline for filing the relevant tax returns. NA. United. When to File Your Return If you file your return on a calendar year basis, the return is due on or before April 15th, A fiscal year return is. You can still file tax returns Even though the deadline has passed, you can file your taxes online in a few simple steps. Our online income tax. IRS electronic postmark as the filing date for your e-filed Oregon return. file your personal income tax return with the Oregon Department of Revenue. If you wish to electronically file your federal income tax return, the Internal Revenue Pay federal taxes electronically - on-line or by phone 24/7. © Additional time to pay your income tax Individual and corporate income tax payments are now due June 1, Applies to payments originally due between April. Georgia income tax returns must be received or postmarked by the April 15 due date. File Income Tax Return · Requesting an Extension · Why Should I File. The original due date to file and pay Illinois individual income tax for calendar year filers is April 15, Income Tax Return, Form N, due date was April 15, Any original Nebraska income tax return for tax year file a claim for refund of income taxes. Federal Tax Deadline Extension On March 18, , in response to the COVID pandemic, the Treasury Department, through the Internal Revenue Service. (e.g. The Quarter 1 (Jan, Feb, Mar) tax return is due April ) Annual returns are due April (e.g. The Annual tax return is due April 15, ). If. Individual · April 15, U.S. nonresidents are required to file their U.S. income tax return (Form NR) by this due date, provided they were employed and. North Carolina Individual Income Tax Return. March 18, NCDOR Extends Individual Income Filing and Payment Deadline to May June 17, NC If you both file and pay electronically, your return is due April 15th. Tax Year Filing Status, Gross Income. Single, 65 or older, $12, Joint. Individual Income Tax Filing Due Dates · Typically, most people must file their tax return by May 1. · Fiscal year filers: Returns are due the 15th day of the 4th. The deadline for most people who need to file a personal tax return is Monday, April 15, For taxpayers in Maine and Massachusetts, the deadline is two. Filing frequencies and return due dates for Iowa Sales and Use Tax and Withholding Income Tax Beginning in for tax year and all subsequent tax years. Returns resulting in a tax due must submit payment by using direct debit (if supported by your software), using Michigan's e-Payment system, or mailing your.

How To Get A Company Credit Card

1. Check your credit scores When you begin your search for a business credit card, you need to understand your credit history and how it can be affected by a. Using our business credit card management platform, you can add or remove employee cards, change limits, track transactions and make payments. A company credit card allows authorized people to buy things for the business without waiting for reimbursement. Cardholders, including employees or other. First, you need to secure bank partners and connect with a credit card network such as Visa or MasterCard. Next, you need to get your processor integration set. You should get a business credit card as soon as you begin making regular, dedicated purchases on behalf of your business. The company credit card for fast-growing businesses. Instantly provision Get up and running with a virtual card in minutes. Credit limits that grow. How many cards can I get for my company? When will I receive my card in the mail? See all FAQs. Other types of financing. Brex is a corporate credit card that's built to help businesses scale. Get Finally, a corporate card companies can trust. Where higher spending power. When you apply for a business credit card, you must provide the same information you'd submit when applying for a personal card. The application will include. 1. Check your credit scores When you begin your search for a business credit card, you need to understand your credit history and how it can be affected by a. Using our business credit card management platform, you can add or remove employee cards, change limits, track transactions and make payments. A company credit card allows authorized people to buy things for the business without waiting for reimbursement. Cardholders, including employees or other. First, you need to secure bank partners and connect with a credit card network such as Visa or MasterCard. Next, you need to get your processor integration set. You should get a business credit card as soon as you begin making regular, dedicated purchases on behalf of your business. The company credit card for fast-growing businesses. Instantly provision Get up and running with a virtual card in minutes. Credit limits that grow. How many cards can I get for my company? When will I receive my card in the mail? See all FAQs. Other types of financing. Brex is a corporate credit card that's built to help businesses scale. Get Finally, a corporate card companies can trust. Where higher spending power. When you apply for a business credit card, you must provide the same information you'd submit when applying for a personal card. The application will include.

Are you considering giving employees a company credit card? Learn how these Consolidate your business credit card statements to get an overview of spending. The vast majority of business credit card issuers make the decision to issue personal credit cards based on a personal credit score and income from all sources. What we'll cover · You need to separate your business and personal expenses · Your personal credit card has a low limit · You have a good personal credit score. What information will I need to provide to apply for a business credit card? As your business grows, an established relationship with a bank could boost your chances of getting approved for the best business credit cards. If you're under age 21 or applying for a secured credit card, you'll have to apply online. All Discover credit cards, including student cards, earn rewards on. Companies typically issue corporate credit cards to key members of leadership leaders who are responsible for spending on behalf of the business. Employees who. This site does not include all credit card companies or all card offers available in the marketplace. We're always here when you need us. Get Support. Report. Each card provider will have different credit score standards for their applications, but that shouldn't stop you from applying. Some card companies may be. A secured credit card for new businesses requires the business to put down a security deposit. How much a business puts down can range greatly. These may be an. One can apply for a Business Credit Card online or visit the branch of any nationalised bank to obtain one. The application process is also like any other. Even if you apply for cards using a business EIN, credit card companies may still run a personal credit check. This "hard inquiry" will likely drop the score. In most cases, businesses without a proven track record are approved for a credit card based on the owner's credit history. Therefore, if you have a low credit. Yes, many limited liability companies (LLCs) have business credit cards. To apply for and get a credit card with an LLC, you must be an owner, officer, or. There are three ways to start a credit card business: affiliate programs, affinity partnerships or by starting a card-issuing company from scratch. What is a corporate credit card? Corporate credit cards are designed for established companies with a minimum of $4 million in annual revenue. How do corporate. How to apply for a business credit card · Step 1: Determine your eligibility · Step 2: Compare the various card types · Step 3: Gather the required information. Easiest business credit cards to get · Best for an average credit score: *Capital One Spark 1% Classic · Best for bad credit: Bank of America Business Advantage. Before you apply for a business credit card, you'll want to assess your eligibility. Typically, criteria includes factors such as the legal structure of your. Here's why: If you want rewards for your company's spending and don't want to track a complicated rewards program, this card offers straightforward rewards with.

Best Email Hosting Provider

Best 8 Cheap Email Hosting Providers of · 1. Google Workspace · 2. Bluehost · 3. Zoho Mail · 4. HostGator · 5. Namecheap · 6. Microsoft · 7. GoDaddy · 8. Top Email Hosting Services for Small Businesses · 1. Google Workspace (formerly G Suite) · 2. Microsoft Business · 3. Zoho Mail · 4. Bluehost · 5. Bluehost is best known for offering web hosting and website builder services, but the company's email hosting packages are great choices for growing businesses. 1. Google Workspace. Formerly known as G Suite, Google Workspace is a powerhouse in the realm of email hosting. With features such as Gmail. I use a provider called Imageway (hey-co-instrument.ru), and they seem to offer really good email hosting. They are non-Microsoft based, and. Secure email hosting for your company. Your business email can be hosted on a secure, encrypted and privacy-guaranteed email service. The data centers at Zoho. In this article, we will review the best email hosting services based on their features and pricing so you can choose the right email hosting service for you. Google business apps cost about $5/month and you not only get gmail style email hosting but also have tons of other google services to take. Let's dive into the world of email hosting and discover the best providers, along with what makes them stand out. Best 8 Cheap Email Hosting Providers of · 1. Google Workspace · 2. Bluehost · 3. Zoho Mail · 4. HostGator · 5. Namecheap · 6. Microsoft · 7. GoDaddy · 8. Top Email Hosting Services for Small Businesses · 1. Google Workspace (formerly G Suite) · 2. Microsoft Business · 3. Zoho Mail · 4. Bluehost · 5. Bluehost is best known for offering web hosting and website builder services, but the company's email hosting packages are great choices for growing businesses. 1. Google Workspace. Formerly known as G Suite, Google Workspace is a powerhouse in the realm of email hosting. With features such as Gmail. I use a provider called Imageway (hey-co-instrument.ru), and they seem to offer really good email hosting. They are non-Microsoft based, and. Secure email hosting for your company. Your business email can be hosted on a secure, encrypted and privacy-guaranteed email service. The data centers at Zoho. In this article, we will review the best email hosting services based on their features and pricing so you can choose the right email hosting service for you. Google business apps cost about $5/month and you not only get gmail style email hosting but also have tons of other google services to take. Let's dive into the world of email hosting and discover the best providers, along with what makes them stand out.

Some of the best email service providers include Gmail, Outlook, and ProtonMail. As long as you're designing for the most popular clients, your emails should. In this blog post, we'll dig into the differences between hosted business email and on-premises email, as well as the best options for small businesses. Secure email hosting for your company. Your business email can be hosted on a secure, encrypted and privacy-guaranteed email service. The data centers at Zoho. 5 Best Email Hosting Services Of · DreamHost · Fastmail · Microsoft · Google Workspace · Zoho Mail · Forbes Advisor Ratings · Methodology · What Is Email. I've tested numerous email hosting providers, easily more than half a dozen, but Zapmail takes the crown. The domain buying and management. The 5 best email hosting providers · Microsoft for companies that use Microsoft apps · Google Workspace for keeping everything on the cloud (and Google. IONOS email hosting service lets you create your own email domain, helping you to craft a professional appearance and stand out from the crowd. Gmail, Yahoo! Mail, and AOL are examples of popular webmail providers. The Head of Sales and trekking expert from Bookatrekking, who specializes in Eagle Walk. 1. Google Workspace. Formerly known as G Suite, Google Workspace is a powerhouse in the realm of email hosting. With features such as Gmail. Comparing the Top Email Providers: Gmail vs. Yahoo Mail Gmail and Yahoo Mail are two of the most widely used services, each offering unique features and. We compile a list of the eight best email hosting providers for small businesses. Several factors we consider include features, resources, scalability, and. Yahoo! Mail is one of the oldest, most established free email services around today, and it has some impressive features. A free email account with Yahoo! Mail. Google business apps cost about $5/month and you not only get gmail style email hosting but also have tons of other google services to take. There are several free hosting services such as hey-co-instrument.ru, hey-co-instrument.ru, Hotmail, and proton mail among others. Free email hosting is the most popular email. List of Top Email Hosting Companies | Best Email Hosting Service Providers · UltaHost · Softxaa · RedSwitches · Prism Events Digital Advertising · Creative Brand. This guide captures everything an entrepreneur needs to know about email hosting services and provides some recommendations for the best email hosting services. Comparing the Top Email Providers: Gmail vs. Yahoo Mail Gmail and Yahoo Mail are two of the most widely used services, each offering unique features and. Small businesses will benefit more from an email hosting service that provides them with custom domains. Don't settle for expensive or unreliable email hosting. Find the top 9 cheap email hosting providers that will boost your business in Best Articles on Building Your Site. How to Make a Website How to Install Our email plan makes it easy to get legit quick. Pro Services · Design Services.

Tax If You Sell Your House

Understanding Capital Gains Tax: Capital gains taxes are fees that real estate investors must pay after selling a property. They are calculated based on the. You can sell your primary residence and be exempt from capital gains taxes on the first $, if you are single and $, if married filing jointly. This. Understanding Capital Gains Tax: Capital gains taxes are fees that real estate investors must pay after selling a property. They are calculated based on the. The IRS allows an exclusion of up to $, of the gain on the sale of your main home ($, if you are married and file a joint return. Most taxpayers can. If you are single and the capital gain from selling your home is no greater than $,, it excludes you from paying the capital gains tax. They will only tax. When you've possessed your home for longer than one year, you'll pay long-term capital gains taxes. Additionally, state capital gains tax rates vary widely —. If you do have to pay capital gains tax, how much you owe will depend on how long you owned the house, your filing status, and your income. Selling a house you'. So if you sold your home for less than what you paid for it, you can't claim that loss as a tax deduction. But there are still a lot of other deductions you can. No income tax is withheld from real estate sales proceeds, whether by the escrow company or anyone else. However, the general rule is that one must pay tax on. Understanding Capital Gains Tax: Capital gains taxes are fees that real estate investors must pay after selling a property. They are calculated based on the. You can sell your primary residence and be exempt from capital gains taxes on the first $, if you are single and $, if married filing jointly. This. Understanding Capital Gains Tax: Capital gains taxes are fees that real estate investors must pay after selling a property. They are calculated based on the. The IRS allows an exclusion of up to $, of the gain on the sale of your main home ($, if you are married and file a joint return. Most taxpayers can. If you are single and the capital gain from selling your home is no greater than $,, it excludes you from paying the capital gains tax. They will only tax. When you've possessed your home for longer than one year, you'll pay long-term capital gains taxes. Additionally, state capital gains tax rates vary widely —. If you do have to pay capital gains tax, how much you owe will depend on how long you owned the house, your filing status, and your income. Selling a house you'. So if you sold your home for less than what you paid for it, you can't claim that loss as a tax deduction. But there are still a lot of other deductions you can. No income tax is withheld from real estate sales proceeds, whether by the escrow company or anyone else. However, the general rule is that one must pay tax on.

This guide will help residents and nonresidents of New. Jersey understand what taxes or fees you may be responsible for, how and when to pay, and what Taxation. If you do have a gain from the sale of your home, you may be eligible to exclude that gain, meaning it's not taxed. You can exclude up to $, if: You have. You may not have to pay federal income taxes when you sell your home due to the $, or $, capital gains exclusion for qualifying homeowners. But if. You may not have to pay federal income taxes when you sell your home due to the $, or $, capital gains exclusion for qualifying homeowners. But if. Your tax rate is 15% on long-term capital gains if you're a single filer earning between $44, to $,, married filing jointly earning between $89, to. No, every two years or longer you can sell your primary residence and pay no capital gains tax up to thousand if married and , if. If you sold your house before a year had passed since you purchased it, you would pay short-term capital gains taxes, which, depending on your income tax group. In most instances you can can sell your primary residence without incurring any tax liability. You can make up to $, in profit if you're a single. All these expenses INCREASE your cost basis, thereby DECREASING your capital gains and your capital gains tax. For example, if you spent $, on home. I sold my principal residence this year. What form do I need to file? If you meet the ownership and use tests, the sale of your home qualifies for exclusion. The gains are reported on Form and Schedule D of your tax return. To be eligible, you must not have received a similar exemption from a property sale in. A home sale often doesn't affect your taxes. If you have a loss on the sale, you can't deduct it from income. But, if you make a profit, you can often exclude. If you are selling your main home or personal residence, you may be eligible for a special exclusion from tax of the gain from the sale. If You Sell Together. If you and your spouse sell your house at the time you're getting divorced, the capital gains tax applies. But you're entitled to exclude. When you sell your home after more than a year of ownership, your profits are taxed as long-term capital gains, which you'll receive lower tax rates ranging. There's a good chance you won't have to pay any capital gains tax when you sell your house, so long as it's your primary residence. However, you may need to. This means that if you bought a home for $, and sold it for $,, you 'd have a capital gain of $, But if you're married, your exemption is. Relief from Capital Gains Tax (CGT) when you sell your home - Private Residence Relief, time away from your home, what to do if you have 2 homes. “You can deduct any costs associated with selling the home—including legal fees, escrow fees, advertising costs, and real estate agent commissions,” says Joshua. If you're planning to sell your home, it's important to know about capital gains tax so you do not get hit with any tax surprises when you file your return.

How To Get Rid Of Old Debt On Credit Report

Removing a Charged-Off Debt That's Been Repaid · If you have a charge-off on your credit report, it's likely been sold to a third-party collection agency. If you face debt collections, this could appear on your credit report and last for up to 7 years. You'll still be on the hook to make these payments, even after. Dispute the old debt directly with the debt buyer. State why you dispute the debt in writing and send it directly to the debt buyer. Once the debt buyer. If you suspect a collection is fraudulent, you should report the fraud at hey-co-instrument.ru and then file a dispute. If the agency verifies that disputed. A pay for delete is one potential option that might help you remove that account from your credit reports and send your credit score moving back in the right. Your original creditor may be most willing to take your debt back if you have already worked out a plan with your debt collector and begun repaying what you owe. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. In order to clear incorrect information, you will have to file a dispute with your credit bureau. This involves submitting a dispute in writing, indicating. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this. Removing a Charged-Off Debt That's Been Repaid · If you have a charge-off on your credit report, it's likely been sold to a third-party collection agency. If you face debt collections, this could appear on your credit report and last for up to 7 years. You'll still be on the hook to make these payments, even after. Dispute the old debt directly with the debt buyer. State why you dispute the debt in writing and send it directly to the debt buyer. Once the debt buyer. If you suspect a collection is fraudulent, you should report the fraud at hey-co-instrument.ru and then file a dispute. If the agency verifies that disputed. A pay for delete is one potential option that might help you remove that account from your credit reports and send your credit score moving back in the right. Your original creditor may be most willing to take your debt back if you have already worked out a plan with your debt collector and begun repaying what you owe. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. In order to clear incorrect information, you will have to file a dispute with your credit bureau. This involves submitting a dispute in writing, indicating. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this.

Verify the Collection: Before taking any action, ensure the collection is accurate. · Dispute Inaccuracies · Negotiate a “Pay-for-Delete” · Settle the Debt. Re-aging is an extremely illegal act that can be detrimental to your credit score, and your life as a whole. Low credit scores not only mean that you may have. This would seem to make sense, if there's an owing balance, and that balance owed could be hurting your credit. Wouldn't it make sense to pay off that balance. If a debt is old, such as five years or so, and you don't plan on buying a home or needing a loan in the next few years, it may be worthwhile to wait until the. A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials. To remove a late payment from your credit report, you can wait for it to fall off, file a dispute or negotiate with your creditor. Learn more here. If you do so, the debt collector can only contact you to confirm that it will stop contacting you and to notify you that it may file a lawsuit or take other. Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report. Even if your debt is several years old and the deadline for filing a lawsuit to collect it has expired, your debt still may be reported to the credit reporting. Remember that paying off an old debt may not erase it from your credit history. Also, if you settle the debt, some collectors will report that on your credit. You can dispute debts off your credit reports that are too old. Not just with Experian, Equifax and TransUnion, but with debt collectors too. If it does make it onto your credit report, yet another form of dispute letter should be sent to the credit-reporting agency, disputing the accuracy of the. You can negotiate with debt collection agencies to remove negative information from your credit report. Outline your dispute in writing and send it to the three major CRAs. They are required under the FCRA to investigate your dispute and remove the negative. To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. Most debt will be removed from your credit reports 7 years after the date of first delinquency. Here are the steps to take to deal with old and charged off. Debtors must directly contact credit reporting agencies to discuss how long a bankruptcy case remains on a credit report. If you have an old debt that you don't believe you will ever be able to repay, find out the statute of limitations on debt in your state as well as the state. Tell the credit reporting agencies to delete the debt from your credit Any company that says it can get rid of your debt is trying to rip you off.